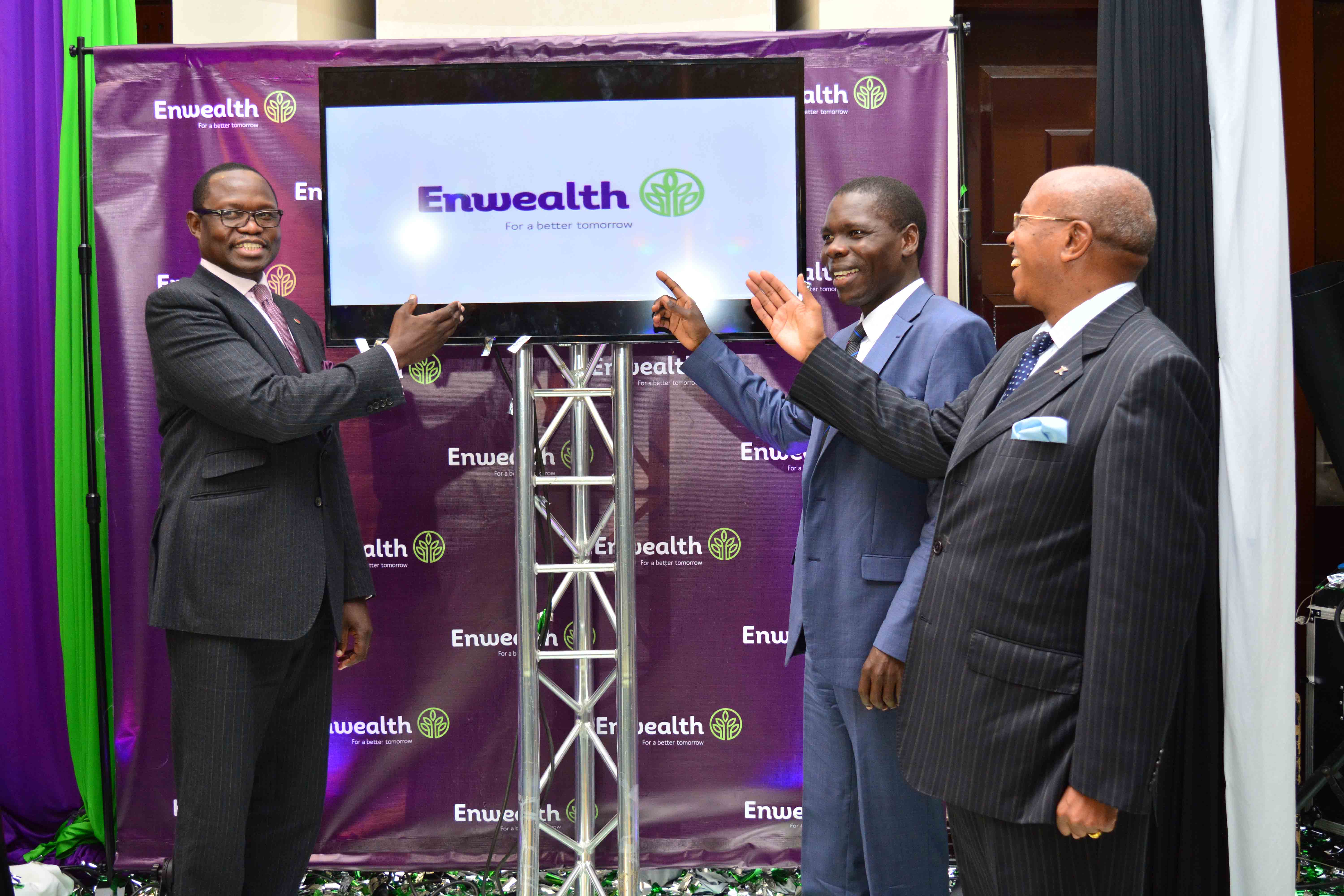

Liberty Pension Services, on Friday, re-branded to Enwealth Financial Services in a move that takes the brand full circle. The financial service company sees a massive overhaul of its brand with a new logo and website. The re-brand comes five years after the company’s inception.

According to the firms CEO Mr Simon Wafubwa, the re-brand has nothing to do with the name but rather as part of a growth strategy increase its market share from 5to 20 percent as it ventures out into the SME market.

Mr. Simon Wafubwa said, “Enwealth’s commitments to ethical business practice and desire to grow past its 5 percent market share, has seen the company craft innovative social security financial solutions that have not only created employment opportunities to serve more than 100 clients but also see its fund value grow to over 40BN in a very short period of time.”

Enwealth also plans to grow its footprint into the African Region with a more comprehensive product offering that includes the post- retirement healthcare funds for retirees and a diaspora pension scheme for retirees. “As we embark on the next phase of this journey, we expect to leverage on technology to drive our market share from 5per cent to 20per cent,” said Mr. Wafubwa.

In line with its commitment to good corporate governance, the company recently appointed Mr. Nelson Kuria the former group MD for CIC, as it’s Board Chair.

On his part Dr. Edward Odundo, CEO at RBA, who was among the guests at the re-branding ceremony, noted that the industry is on a steady growth path. “The industry is expected to hit the KSh1 trillion mark by end of 2016 should we maintain the growth momentum of the assets base at 10per cent annually.”

“This is a clear indication of the critical role that the pensions industry plays in the economic growth agenda of the nation,” he added. The retirement benefits industry assets have grown tremendously from KSh50 billion in 2000 to KSh814 billion in 2015.