By Ben Oduor and Tullah Stephen

Equity Bank Group on Monday announced that it had posted a KSh 10.1 billion in profit after tax marking an 18 per cent growth in its half year ended June 2016. The group’s pretax profit also grew by 18 per cent to KSh14.23 billion up from KSh12.10 billion in the same period last year.

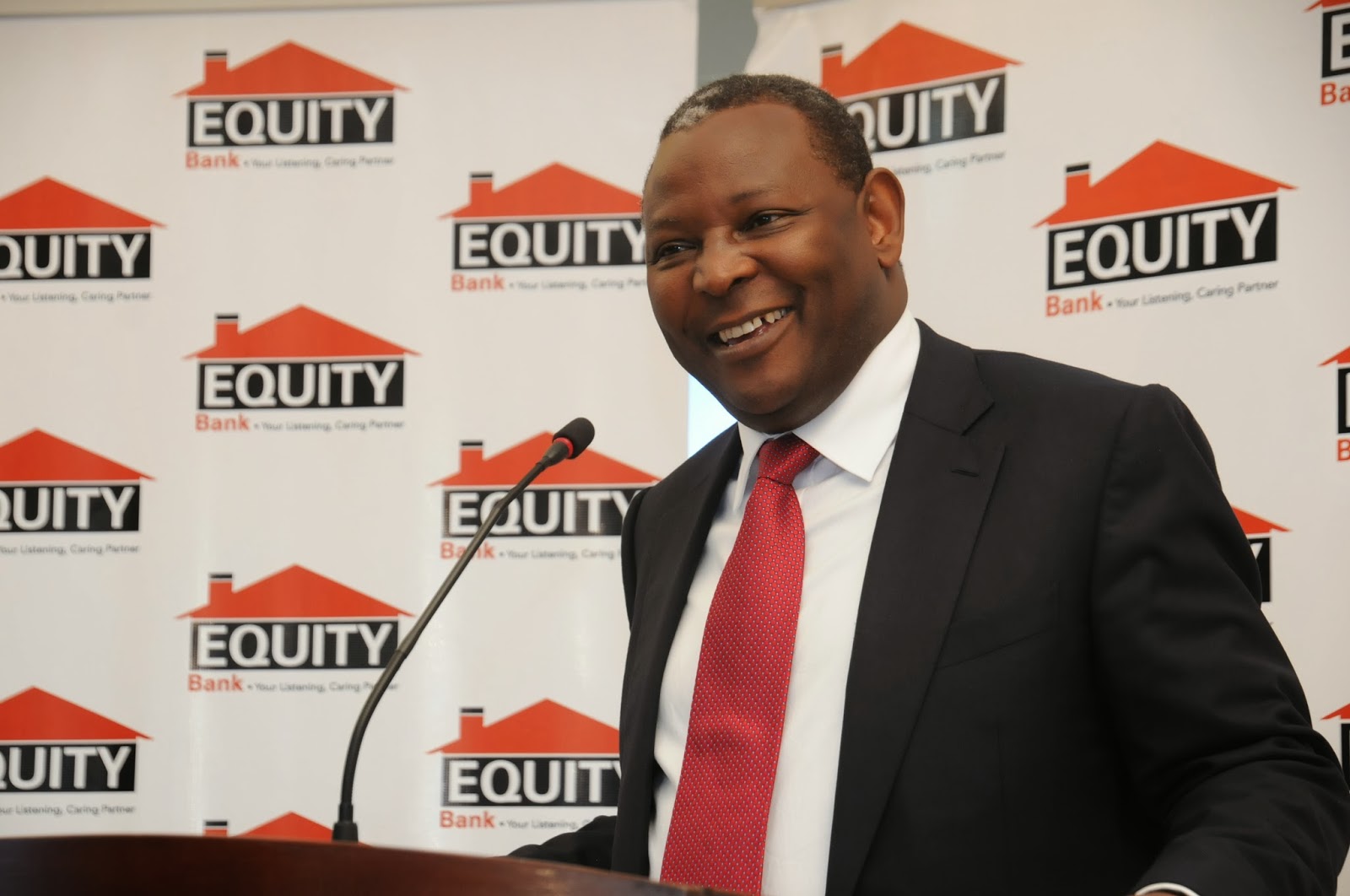

According to the groups CEO James Mwangi, the result is attributed to the successful execution of an innovative business strategy dubbed Equity 3.0. “The strategy is centred on digitization, disruption of delivery channels, transforming the business model and redefining customers banking services and products access experience.”

The bank recorded an 8 per cent year on year growth in its loan book in its Kenyan business. This is compared to 22 per cent it experienced during the first quarter of the year. This was largely affected by the high interest rates in line with the overall slowdown of the banking sector.

The total loan book however, expanded by 13.6 per cent to KSh 269 billion. “The convenience and ease of accessing credit and loans through the Equitel mobile channel saw the number of loans disbursed increase by 308 per cent to 4.3 million up from 1,million hence boosting our loan book.” The bank’s Democratic Republic of Congo’s subsidiary posted the strongest growth of 45.0 per cent year-on-year. DRCs business accounted for 5.8 per cent of total loans. Devaluation of the south Sudanese pound saw a 91 per cent decline of the loan book to KSh 300M.

Customer deposits reported a 6.5 per cent year on year growth to KES 319.2 billion. the banks subsidiary in Rwanda led the pack with deposits of KSh 10.7billion, DRC recorded KES 20.1billion. Kenya business recorded a 10.0 per cent year on year increase to KES 259.1 billion up from Ksh 236.4 billion while South Sudan lost reported deposits of KSh10.3 billion which was 69.0 per cent loss.

Despite the sluggish loan book and deposits growth notwithstanding, higher interest rates worked in favor of the bank as the net interest margin increase by 11.3 per cent owing to the yield on interest earning assets rising faster than the cost of funds.

Consequently, net interest income recorded 36.9 per cent year on year to KES 21.2B. Net interest income recorded minimal growth at 3.5 per cent quarter on quarter with the net interest margin declining an indication that the bank’s lending rates are now trending downwards.

Year on year increase in staff costs by 19.4 per cent, rental expenses 15 per cent and depreciation expenses which grew by 19 per cent mainly attributable to the acquisition of Pro-Credit Bank DRC in FY15 saw the total operating expenses increase by 17.1 per cent year on year to KSh 15.9billion.

For the second half of the year 2015 the operating expenses grew by 8.8 per cent. “Operating expenses are expected to decline in the next three years to see the cost to income ratio decline to 40.0 per cent from the current level of 49.6 per cent,” said Dr Mwangi.

Non Personal Loans (NPL) also grew by 19 per cent to KES 12.9 billion as the banking sector continued to face challenges in the wake of a spike in interest rates from the third quarter of 2015 as well as a slowdown in government payment. However, the NPL ratio increased by a marginal by 4.7 per cent, well below the psychological 5.0 per cent and 8.2 per cent sector average.

Going forward, the group said it has set its focus on innovating products, deepening focus on SME sector and rooting its presence more in the region.