The Market Days, an initiative of the African Development Bank and seven other co-founding partners is taking place in Marrakech, Morocco over the next three days.

The platform of Market Days this year themed Unlocking Africa’s value chains advances projects to bankability, raises capital, and accelerates deals toward financial closure. The 2023 Market Days run from 8 to 10 November. Previous iterations of Market Days have drawn more than 16,500 participants and generated cumulative investment interest of nearly $143 billion.

The theme of the 2023 Market Days is Unlocking Africa’s value chains. The forum helps connect investors with bankable deals in several sectors including renewable energy, agribusiness, and the manufacture of lithium-ion batteries for electric vehicles.

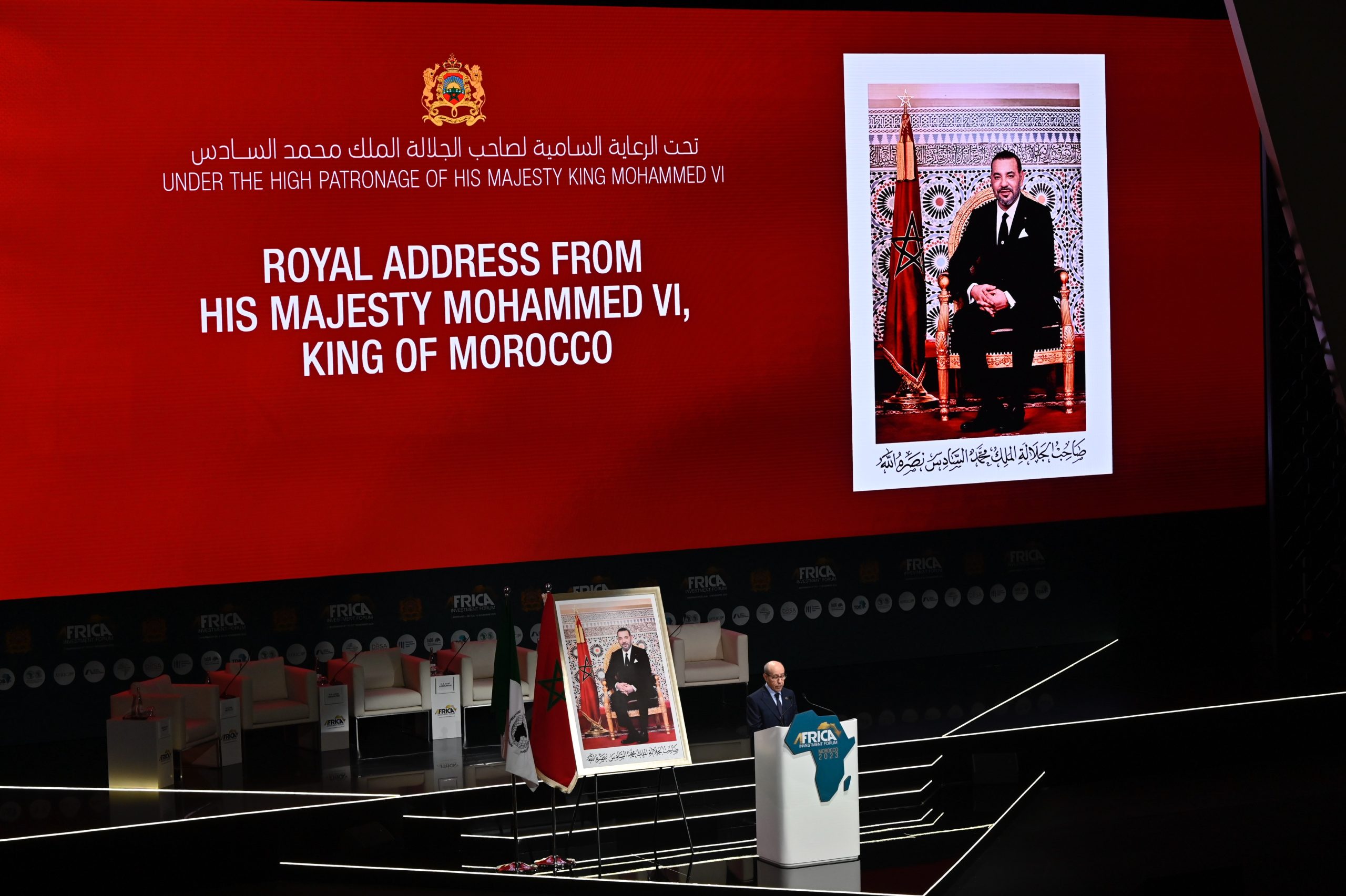

Morocco’s King Mohammed VI in his opening speech at the 2023 Africa Investment Forum Market Days on Wednesday called for Africans to work together to attract the levels of private investment needed to drive the continent’s inclusive development.

“Africa needs now more than ever bold, innovative initiatives to encourage private entrepreneurship and unleash the full potential of our continent,” King Mohammed VI said in a keynote speech read on his behalf by his advisor Omar Kabbaj, a President Emeritus of the African Development Bank.

The King said Morocco could serve as a model for other African countries’ efforts to overcome their infrastructure gaps. “Over the past two decades, Morocco has made infrastructure development a priority in all economic sectors,” he said. He also informed the gathering that the country was pushing toward deriving over 52% of its national electricity mix from renewable energy by 2030.

King Mohammed VI of Morocco

The King also stressed that African countries should enhance “coordination and cooperation mechanisms to drive regional integration.” As an example of the country’s push to partner with neighbors, he cited the Morocco-Nigeria Gas Pipeline Project. The project will “enable all countries along the pipeline route to have access to reliable energy supplies and to be more resilient to exogenous energy price shocks.”

Several heads of state and over 1000 participants including CEOs, heads of multilateral and regional financial institutions, business leaders and project developers, and government ministers are attending the 2023 Market Days. Heads of state and government took the opportunity to make the case for investment in their countries by participating in deal-focused boardrooms and thematic plenaries.

They include Azali Assoumani, President of the Union of Comoros and current chairperson of the African Union, Tanzania’s President Samia Suluhu Hassan, the President of Sierra Leone Julius Maada Bio, Rwanda’s Prime Minister Eduardo Girente and the Prime Minister of Barbados Mia Mottley.

A platform for smooth investments into Africa

In his keynote address, Dr Akinwumi A. Adesina, President of the African Development Bank Group, highlighted Africa’s prospects as a prime investment destination. He remarks that the continent is not as risky as perceived and is growing and showing resilience despite global challenges, as he offers reasons for global investors to pursue high-risk-adjusted returns in Africa. “As investors, put your monies where the future is—The future is Africa,” he said.

As investors, put your monies where the future is—The future is Africa

The President of Comoros, Azali Assoumani, pointed out that manufactured African exports account for just 1% of world exports. H.E Azali seized the opportunity to reveal that we export them to developed countries and these countries re-export them to us process and sell them back to us at ten times the price. Despite the obstacles, there are enormous opportunities for developing value chains in Africa.

According to President Samia Suluhu Hassan of Tanzania, technological and aviation connectivity is a problem in Africa a matter she urged for more investments in to power the continent’s connectivity. She shared her surprise about having had to travel via Paris from her country in East Africa to her destination in Dakar, West Africa.

President Samia Suluhu of Tanzania

President Julius Maada Bio of Sierra Leone said, “Obstacles are opportunities and how we turn obstacles into opportunities is the most important thing. Our economies are not sufficiently diversified and as soon as there is a shock, we suffer the consequences. And we are at the mercy of fluctuations in commodities like oil.”

Barbados Prime Minister Mia Mottley thanked the government of Morocco and the African Development Bank for inviting her, allowing Africans and Caribbeans to reclaim our Atlantic destiny. “We are finding more and more that opportunities for synergies and solidarities are clear,” she said. Mottley has been a forceful voice on behalf of the global south. In 2022, ahead of COP27, she announced the Bridgetown Initiative, an agenda for the reform of global financial architecture and development finance in the context of three intersecting global crises: debt, climate, and inflation.

Barbados Prime Minister Mia Mottley

“Don’t ask us to choose people over planet or planet over people,” Mottley said, recommending a unified approach to the creation of a level playing field. She said there was scope for African and Caribbean people to partner in a range of spheres including pharmaceutical development and tourism, particularly the cruise ship industry.

Rwanda’s Prime Minister Édouard Ngirente commended the Africa Investment Forum for its focus on discussing action rather than potential talks emphasizing the need for action now. He further urged for the removal of barriers to the free movement of people.

Adesina, the chairperson of the Africa Investment Forum, also praised the platform. He said, that what makes the Africa Investment Forum unique and remarkable is that it is highly innovative and 100% transactional. “We develop and curate projects, reduce transaction costs and risks, and accelerate the closure of deals,” Adesina said. “Our goal is simple: make investments to land in Africa smoothly.”

He urged attendees to seize opportunities presented during the Market Days: “Let us be concrete, bold, and decisive. The boardrooms have been well prepared. The clock is ticking. The project developers are here. The investors are here. The heads of state and governments are here. And the financial institutions are here. So, let the deals begin.”

Adesina also conveyed the solidarity of Africa Investment Forum partners for Morocco following the devastating earthquake that struck the country in early September. The African Development Bank will commit €782 million to help finance various projects in Morocco in 2023.

The Africa Investment Forum’s eight founding partners are the African Development Bank Group, Africa50, Africa Finance Corporation, Afreximbank, Development Bank of Southern Africa, European Investment Bank, Islamic Development Bank, and Trade and Development Bank.