Digitization of payments has helped farmers in Kenya boost their income and combat poverty, a new case study by UN based Better Than Cash Alliance has shown. The study which focused on One Acre Fund an agricultural NGO, revealed that digitization had helped boost transparency and efficiency in the payment system. As a result, this drove economic opportunity and financial inclusion for thousand of smallholder farmers and their families.

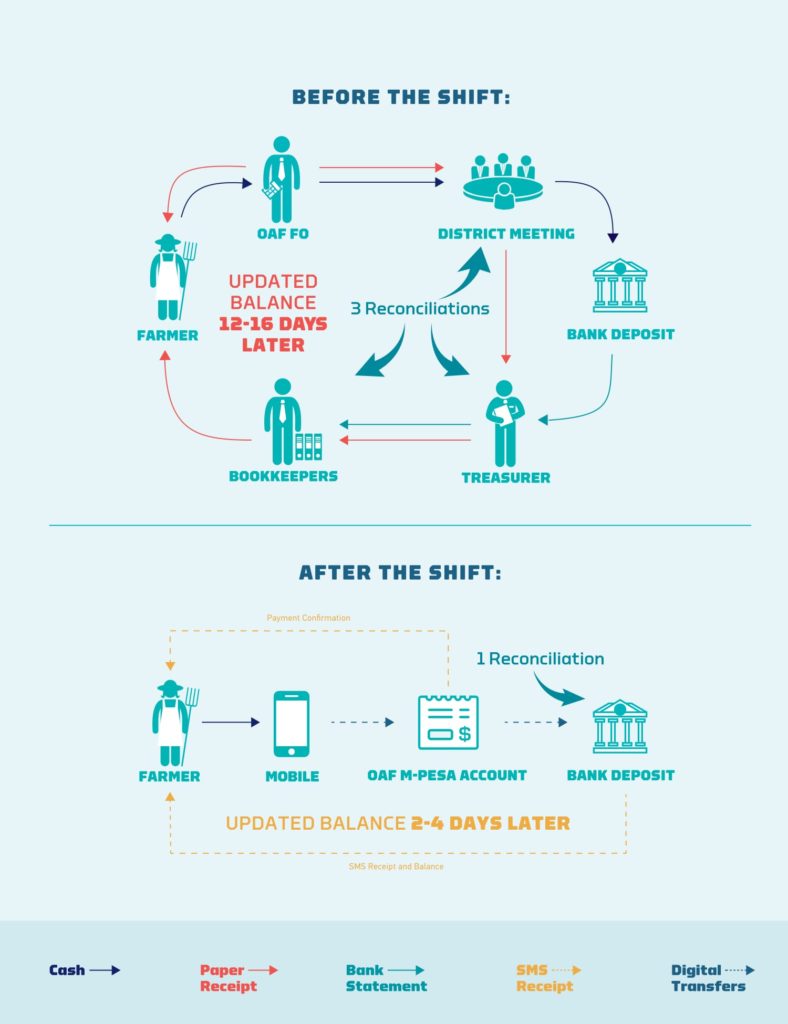

One Acre Fund, digitized its loan repayment enabling farmers to easily make loan repayments via mobile money instead of cash. This helped reduce the uncertainty, inefficiency, insecurity and high costs previously caused by cash transactions.

One Acre Fund can now reach more farmers with greater reliability, and staff can spend almost half as much time collecting payments in cash. Inn addition they can use the extra time to help farmers increase their incomes through training and educational programs.

According to the study, One Acre Fund’s package of services, including training and inputs like seed and fertilizer, the average farmer participating in the program earned nearly 50 percent more than peer farmers who do not participate.

“We’re excited to be working at the forefront of this technology in the smallholder agriculture lending sector. In our experience, farmers were empowered to thrive in these communities. Clients receive immediate confirmation of payments as they happen, enabling them to better manage their businesses and family finances,” said Mike Warmington, the Director of Microfinance Partnerships at One Acre Fund.

“For companies and nonprofit organizations who want to work in rural Africa, this success story is a must-read,” said Oswell Kahonde, Africa Regional Lead at the Better Than Cash Alliance.

“Digital payments are essential to building sustainable business models and creating long-term impact. By enabling smallholder farmers to make and receive payments digitally, we are creating transparency and accountability which translates to numerous benefits and empowers people to take control of their finances.”

Key Highlights from the study:

- Increased participant satisfaction due to transparency and convenience.

- Eighty-five percent decreased instances of repayment fraud.

- Reduced processing time for each repayment from 12-16 days to 2-4 days; farmers now know immediately when their payment is received, eliminating the worry about whether it arrived.

- Eighty percent decrease in repayment processing costs.

- Forty-six percent of time reduced for staff working on collections, allowing for more time helping farmers improve agricultural practices.

- Women farmers benefited especially, feeling safer about payment deliveries.

Click here to download the case study http://APO.af/v5Wxdm