The Kenyan economy expanded by 5.6 percent in the first half of 2019, lower than the growth of 6.4 percent recorded in the first half of 2018, with the financial services sector and insurance sector registering the most improved growth of 2.1 percent points, to 6.7 percent in the first half of 2019, up from 4.6 percent in the first half of 2018.

According to the latest report from Cytonn, key highlights from the industry performance for the Insurance sector in first quarter of 2019 are that it offers benefits such as convenience, adoption of technology as well as the availability of a population that has disposable incomes.

“The insurance sector has benefited from convenience and efficiency through adoption of alternative channels for both distribution and premium collection such as bancassurance and improved agency networks,” explains the Cytonn report.

The insurance industry has also benefited from an advancement in technology and innovation making it possible to make premium payments through mobile phones.

Another factor driving growth in the insurance sector is the growing middle class, which has led to increased disposable income, thereby increasing demand for insurance products and services.

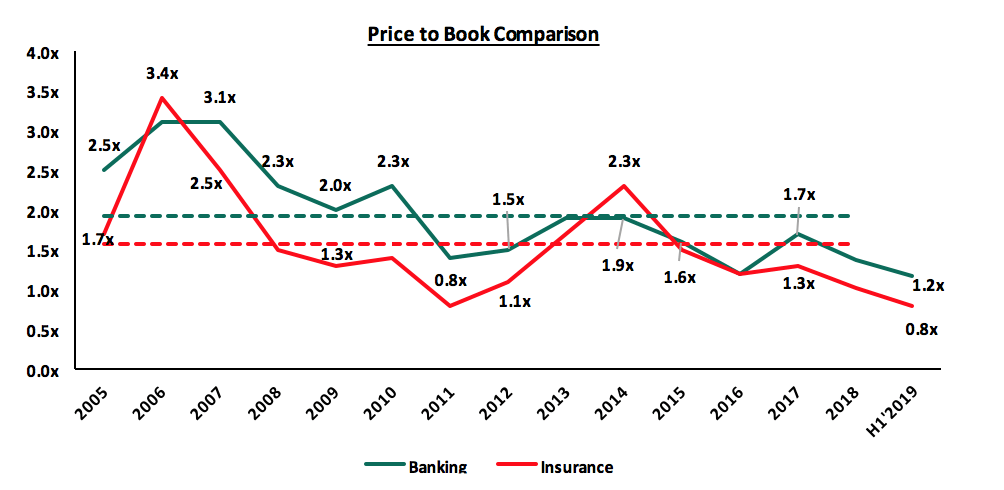

On valuations, listed insurance companies are trading at a price to book of 0.8x, lower than listed banks at 1.2x.

According to the evaluation by Cytonn, these are both lower than their historical averages of 1.6x for the insurance sector and 1.9x for the banking sector.

The Cytonn report deduces that both the banking and insurance sectors are attractive for long-term investors supported by the strong economic fundamentals and favourable investment environment.