Spacecoin, through its parent company Space Telecommunications Inc. (STI), has formalised strategic agreements with telecommunications regulators and local industry partners in Kenya and Nigeria.

This marks a major step in its expansion of satellite-based connectivity solutions across Africa. The partnerships are aimed at accelerating the deployment of decentralised satellite internet services in under-connected regions, supporting the operationalisation of Spacecoin’s permissionless satellite network in markets where conventional terrestrial infrastructure remains limited or prohibitively expensive.

Licensing Progress in Kenya and Nigeria

In Kenya, Spacecoin has been granted a transmission licence by the Communications Authority of Kenya (CAK), authorising the deployment of satellite-enabled Internet of Things (IoT) monitoring and connectivity solutions.

The approval also allows the company to conduct technology demonstrations, a critical milestone in addressing digital inclusion challenges in rural and peri-urban areas where broadband access remains constrained.

In Nigeria, Spacecoin is building on an existing licence issued by the Nigerian Communications Commission (NCC). Working with local partners, the company is advancing plans to roll out high-speed, lower-cost connectivity solutions tailored to rural communities and enterprise users.

Given Nigeria’s status as one of Africa’s largest and fastest-growing digital markets, the collaboration is expected to play a significant role in expanding satellite connectivity across West Africa.

Under the partnership model, Spacecoin provides the core satellite technology and network infrastructure, while local partners manage ground operations, regulatory compliance, and customer support.

The initial pilot projects are designed to stimulate early adoption and lay the groundwork for broader commercial deployment as regulatory frameworks and infrastructure readiness continue to evolve.

Satellite Constellation Expansion Supports Rollout

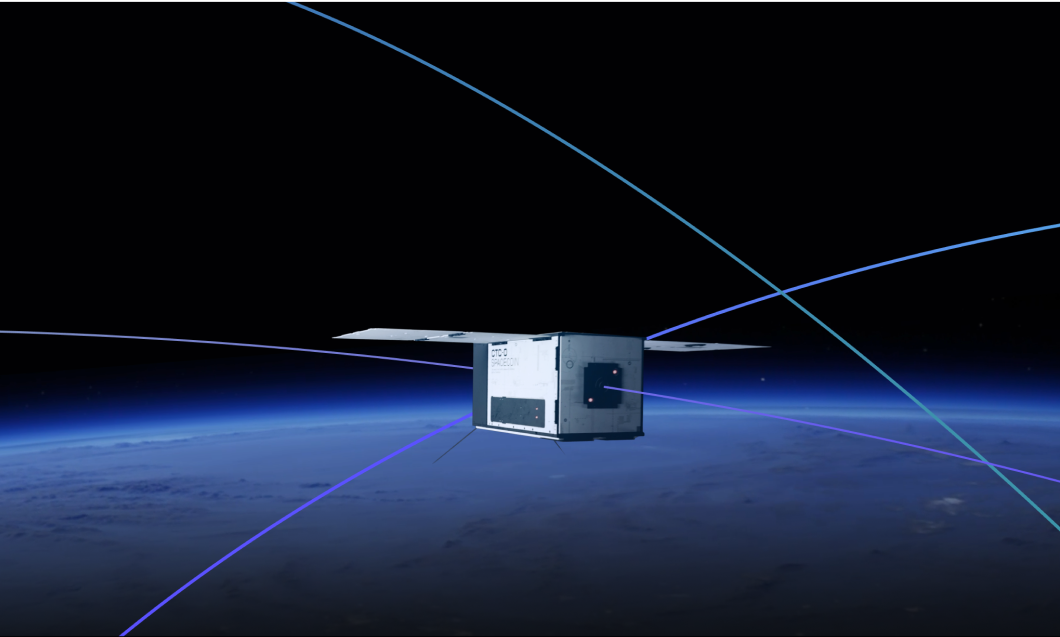

The regulatory and partnership milestones follow Spacecoin’s launch of three additional CTC-1 satellites on 28 November 2025. The expanded constellation enhances real-time inter-satellite communication and seamless handovers, enabling the company to transition from prototype demonstrations to operational service delivery in priority markets.

Spacecoin’s entry into Kenya and Nigeria positions it as an emerging alternative in satellite broadband markets that are still in early stages of development.

In both countries, where Starlink has been the dominant satellite internet provider, Spacecoin’s arrival is expected to increase competition, expand consumer choice, and potentially exert downward pressure on pricing as the market matures.

In Kenya, the timing is particularly notable, as the CA has actively encouraged the introduction of new satellite technologies to close persistent connectivity gaps.