AAR Insurance, in partnership with the Kenya National Chambers of Commerce, held the Uasin Gishu Chapter Business Forum at Rupa’s Mall in Eldoret town.

The business forum, themed ‘New Opportunities in the Upcoming City’ sought to highlight emerging business opportunities and attract investment in the city of champions and the larger Uasin Gishu County.

It was graced by Uasin Gishu County Governor H.E Hon. Jonathan Bii Chelilim, who was the guest speaker, H.E. Saqlain Syedah High Commissioner, Pakistan, Mr. Kiprono Kitony EBS – Chairman Nairobi Securities Exchange(NSE), the Kenya National Chamber of Commerce and Industry (KNCCI) President Richard Ngatia and Justine Kosgei, the Principal Officer AAR Insurance.

The AAR Insurance Principal Officer, Justine Kosgei, lauded the initiative as a step in the right direction, opening up business opportunities to empower the local MSMEs.

“AAR Insurance is cognisant of the integral role of MSMEs in developing our country’s economy. It is estimated that there are over 7.4 million MSMEs in Kenya, cutting across all industries and employing approximately 14.9 million people,” said Justine.

Further highlighting that this is undoubtedly a great source of competitiveness and innovation. For these reasons, AAR Insurance is committed to supporting MSMEs by developing flexible, tailor-made insurance solutions for different demographics adaptable to ever-growing customer needs.

“A case in point is our MSME’s medical cover, which has no waiting period and does not require medical evaluations at the point of onboarding. Additionally, the cover accommodates between 3 to 100 members and includes family planning, free annual checkups under the inpatient benefit, and travel and personal accident cover for principal members,” added Justine.

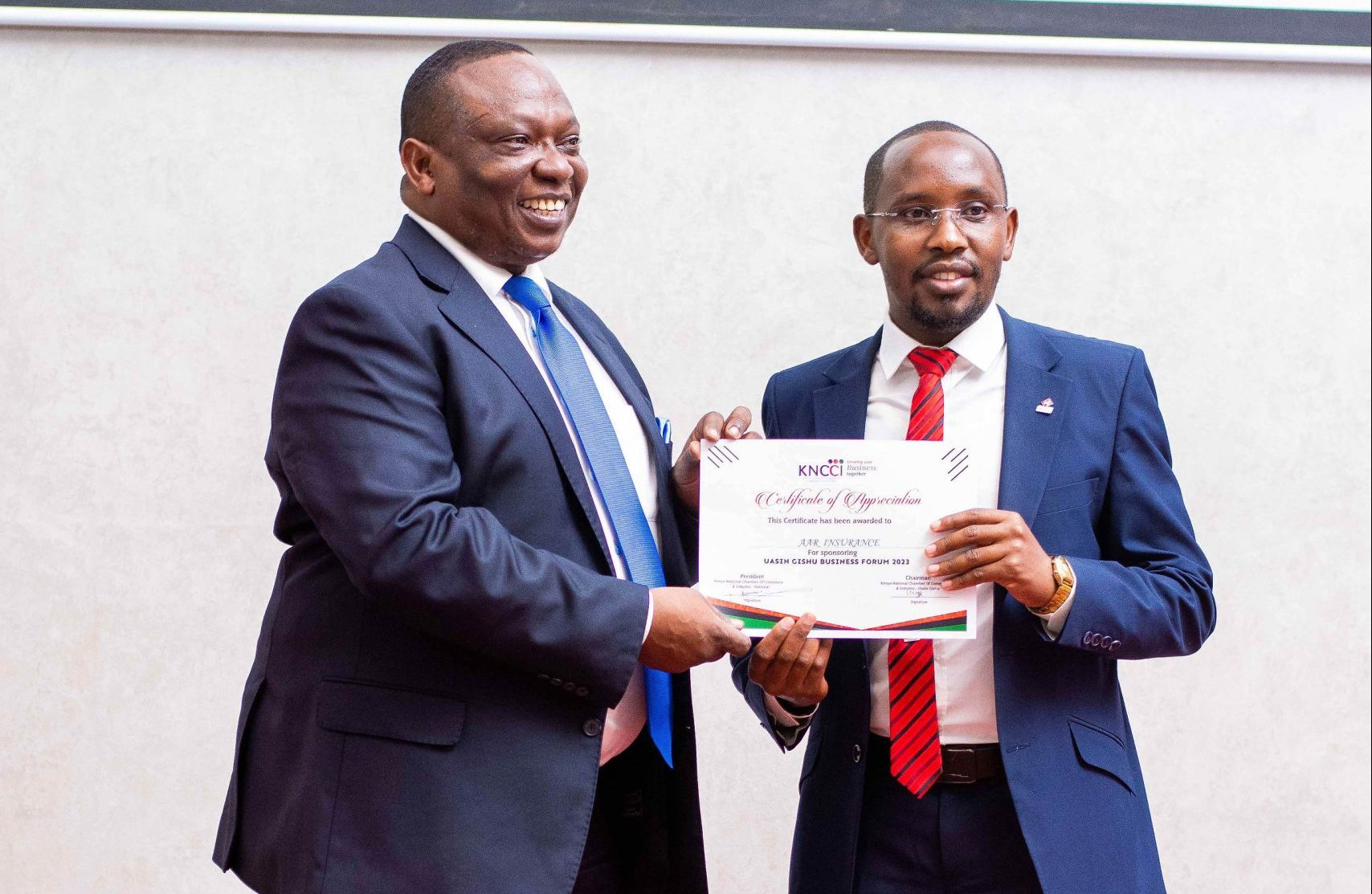

AAR Insurance Group Chief Finance Officer, Hosea Kiprop presenting a gift to Nancy Muthoni at the KNCCI Uasin Gishu Chapter Business Forum

AAR Insurance has been on an aggressive technology-first business approach to increase the penetration of its innovative products to underserved communities.

The KNCCI has a long-standing history of empowering the business community and has been at the forefront of championing a friendly business environment while addressing some of their members’ pressing challenges, including the high cost of finance, high cost of electricity, lack of markets for goods and services and general lack of adequate entrepreneurial skills among members.

“The MSMEs sector undoubtedly drives our country’s economy; we are sure the future has endless possibilities. This is why through the KNCCI, we are deliberate about “Growing Your Business Together” by empowering our members through several game-changing projects that include the SME Academy to enhance the competitiveness of youth and women-led MSMEs through financing, innovation, and entrepreneurship. In addition, we are also continuously advocating for bilateral agreements with other countries to create employment opportunities for our people,” said the KNCCI President, Mr. Richard Ngatia.

He further stated that for instance, Kenya and Germany intend to invest in Agriculture by ensuring there are warehouses, and cooling systems. This initiative will no doubt boost the Agricultural sector while reducing wastage and shortage of food.

The Uasin Gishu County Governor, H.E Hon. Jonathan Bii Chelilim, gracing the occasion assured all the business persons and residents of safety and soaring operations.

“We assure all investors that Uasin Gishu county has a favorable business operating environment. We have ensured that there is flexibility and efficiency in our operations through the automation of revenue collection and issuance of trading licenses in a bid to support businesses,” he said.

Furthermore, acknowledging the importance of the MSME sector to the revenue of this county, we have established the County Enterprise Development Fund and the Inua Biashara Fund to empower our youth and women to grow their businesses.

“We appreciate the support from the KNCCI and AAR Insurance and believe this is only the beginning of greater things to come,” added Governor Jonathan.